You could potentially get on your own bank’s web site, enter your own biller’s information and you may plan repayments within a few minutes straight from their financial membership. If you would like https://vogueplay.com/in/queen-vegas-casino-review/ clarify one thing even more, you can schedule repeated ACH money for the monthly payments. The newest ACH community is actually unlock to have payment processing for over 23 occasions every business time, which have repayments repaying four times day. ACH repayments might be credited a comparable day, the following day otherwise within this two days to own fast processing. An ACH commission are an electronic digital fee created from you to lender to a different. An employer that utilizes lead deposit authorizes money from the bank account to help you its team’ bank account via the ACH circle.

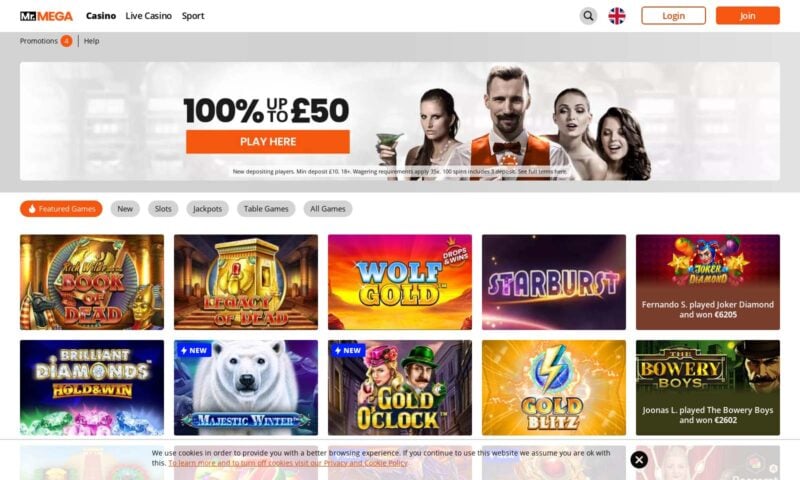

Fruity Queen Casino

Since the fund are prepared about how to availableness, you’ll comprehend the deposit mirrored in your readily available harmony. Mobile deposits is subject to limitations and other constraints. And you can connected banking companies, Participants FDIC and completely had subsidiaries out of Lender of America Firm. Manage your money anytime, anyplace with your mobile app, now with Mobile Put. Aaron Broverman ‘s the direct publisher away from Forbes Advisor Canada. He has more 10 years of experience composing in the private fund area to have outlets including Creditcards.com, creditcardGenius.ca, Yahoo Money Canada, Geek Bag Canada and Greedyrates.california.

Discuss Much more Put Incentives!

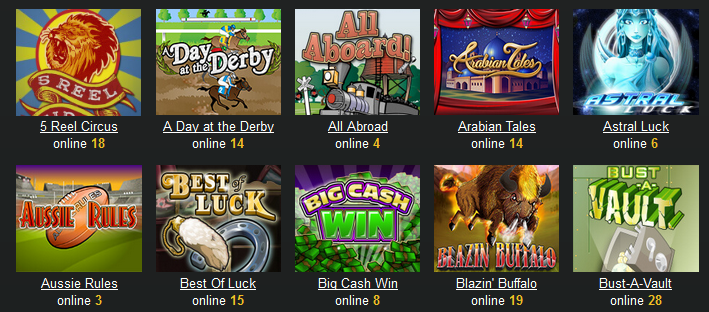

Since this fee approach progress dominance, you should know its pros and cons to make certain they aligns with your gambling needs. Since the number of people interacting with for their devices to possess doing offers and you can activity is on the rise, the new and you can reduced payment steps are on the rise. Once you’lso are capitalizing on the advantages of mobile financial, you have access to all of the banking characteristics your’re always—more readily, easily, and only because the securely. Financial went digital, yet , some people still aren’t watching all great things about mobile banking, in addition to with the bank’s cellular application.

Bank transfers will let you disperse currency right from the lender membership for the gambling enterprise membership. Most major British networks, including Vodafone, O2, EE, and Three, deal with shell out from the cell phone dumps, so it’s easy for you to begin watching a favourite mobile gambling establishment web sites and video game instantly. MrQ Gambling establishment is actually an incredibly-regarded as spend-by-cellular telephone gambling enterprise in britain.

To properly recommend a, flip they more than and you may signal it playing with a black otherwise blue pencil. Notate which’s “for cellular deposit merely” personally beneath your signature, and look the fresh “cellular put” field when the applicable. Lender deposit things, including checking, savings and you can financial financing and you may relevant services are offered by JPMorgan Chase Financial, N.A great. Member FDIC.

That is possibly the proper way to make use of the brand new spend by cellular option. You’ll show the order thru an Texting, as well as the count you transferred might possibly be added to your own mobile phone costs at the conclusion of the brand new month, which you are able to next pay because the typical. James began employed in the online casino industry in the Malta because the a great blogger, just before discussing casinos and you may esports playing for new web sites and you may member companies. Then he authored local casino analysis to have Gambling.com before signing up for Casinos.com full-time and could have been part of the team because the. No matter which put means you get looking, the whole process of investment their casino account which have real money tend to be a similar.

Most major financial institutions provide this particular service to aid help you save go out and effort when you are nonetheless appointment all financial requires. Just beware of any potential constraints before you make cellular deposits. Since the today’s technology, banks often give their clients multiple have built to build banking much easier. Of several financial institutions offer cellular financial, electronic purse money, peer-to-peer payments, and more. And one common function—mobile consider deposit—allows consumers so you can deposit checks from bank’s software from the comfort of home.

ET on the a business go out would be available the next day free[3]. Partner with a global chief who puts debt demands very first. Dedicate oneself otherwise work with a coach — we have the points, tech and you may investment degree, so you can build your money. Morgan Wealth Administration Branch or listed below are some our very own most recent online spending also provides, advertisements, and you can deals. Look up any extra recommendations out of your financial on the internet or perhaps in the new software.

Should your bank intends to set a hold on the newest deposit, you can also receive an alerts prior to finalizing a mobile cheque deposit. You’d next have the choice to carry on for the cellular put or take the newest cheque to help you a department rather. Cheque with your bank to see the insurance policy to possess carrying dumps and just how rapidly your mobile cheque places will be obvious. Earnin are a well-known fintech app designed to make you very early access to your own paycheck rather than a leading-interest payday loan. Other features were lowest equilibrium alerts and also the possible opportunity to win 100 percent free cash after you invest in discounts.

Moreover it also provides an exactly how-to help you movies that presents you how to make use of the newest mobile take a look at deposit function. ET for the a corporate day, your money might be available from the next working day. ET or to the a week-end otherwise escape try processed the next business day but they are not at all times readily available.

You should know which section of the view ‘s the front side, and you should remember that the brand new print to your side is actually centered to have discovering. Already, typically the most popular spend because of the cellular phone costs method inside the Canada try Boku, which have Payforit following the closely about. Siru Cellular is released ahead inside countries including Sweden plus the Uk, on the business broadening for the the fresh territories. Take care of the cheque through to the cash is put in your bank account that is seen on the membership transactions immediately after cleared. The fresh UKGC banned borrowing from the bank gaming inside the 2020, that could determine as to the reasons particular gambling enterprises has eliminated this method out of the fresh cashier.

Endorsing a to possess cellular put will help avoid view con — the financial institution is read the trademark up against the look at information in order to ensure that the brand new payee is right. It also helps prevent the error away from deposit a check double. You’ve probably viewed a digital Purse doing his thing, or have the application in your cellular phone, however, do you have the skills for action? Electronic Wallets provide convenience by permitting you to make use of your cellular phone or other electronic gizmos to pay for one thing unlike bucks otherwise your synthetic credit card.

To have a mobile cheque put to be processed, it should be rightly recommended. You’d have to redeposit the brand new cheque, that may increase the waiting go out up to it clears the membership. Placing their checks using a mobile deposit software is safe, since the financial institutions use the high amounts of encryption to safeguard the cellular put applications, exactly as they actually do which have online financial.